Tax Savings: Easiest Ways To Earn More WITHOUT Sponsoring

There are 2 ways to increase your wealth in your MLM business.

Make more money (duh!)

Or

Keep more money! (bet you didn’t think of that did you?!)

The first one is obvious but not the second.

You don’t need to necessarily have to make more in order to be wealthier.

You can simply KEEP more of what you currently have.

Learn to Keep an Extra $3,000 to $9,000 a Year

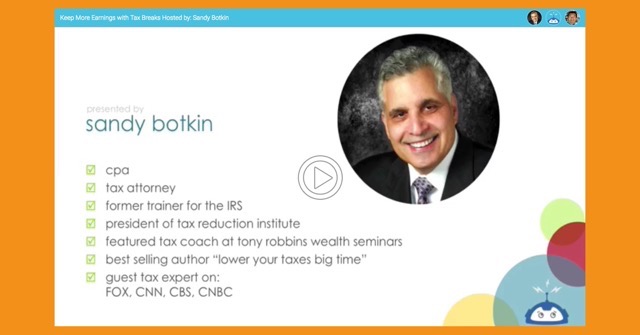

I recently did a webinar with Sandy Botkin, who talked about how to “Keep More Money with Tax Breaks” from a network marketing business.

Sandy Botkin is a former IRS attorney, a CPA, Tax Attorney and has been training millions of small businesses how to get their taxes down to the legal limit.

Click below to watch the recording:

How to Qualify for Tax Savings

Almost every MLM distributor qualifies for these tax savings.

Here is a quick checklist of things you should do:

1) Treat your MLM business as a business and NOT a hobby

Document and track everything

2) Work consistent regular hours

This is good for you. It’ll force you to work on your business every single day and have “regular business hours” or set times where you just go and prospect.

3) Use a good tracker tool

You can use Taxbot app or a comparable tool to track expenses

4) Have an accountant that understands your business

The person doing your taxes should understand home businesses

5) Document everything

Always document what each expense is for.

Was that cup of coffee purchased at Starbucks to meet a prospect?

On each receipt you should write down the name of person and what was covered in that business meeting

Mistakes To Avoid With Tax Savings

Chances are you know that you can save money through legal tax deductions but you’re at risk if you make these common mistakes

1) Not Planning for Taxes

The MLM income is nice but don’t forget you have to pay your taxes on that income.

You should set asides a certain amount each month and pay your taxes quarterly.

2) Lack of Documentation

This will get in trouble with the IRS.

Most distributors are lazy with their documentation and do it last minute.

Bad documentation is what the IRS goes after so make sure you use handy tools such as Taxbot to track and document all your expenses.

3) No Tracking

What doesn’t get tracked can NOT get improved.

Most MLM distributors just focus on earning the money but don’t pay attention to the legal tax loopholes that they can maximize

Tax Loopholes

Here are common loopholes that you should take advantage of.

Watch the recorded webinar to hear Sandy go more in detail

1) Pension and 401k plans for entrepreneurs

2) Entertainment expenses

3) Income shifting (for i.e. hiring your kids)

4) Dry cleaning

5) Medical expenses

and more.

Watch the recorded webinar to get more details

Maxing Your Tax Savings

Go watch the recorded webinar below to learn more

To get your documents more organized, also use a tracking app such as Taxbot.